Share markets were supported over the last week by good economic data, solid US earnings results and ongoing signs that central banks are moving towards rate cuts albeit they are pushing back against imminent moves. For the week US shares rose 1.4% to a record high with a blowout payroll report adding to confidence in the economy even though it will keep the Fed cautious. Japanese shares rose 1.1%. But Eurozone shares fell 0.1%, and Chinese shares fell 4.6% on concerns that stimulus and market support measures are still not enough in the face of the Chinese property downturn. The combination of lower-than-expected local inflation, increased expectations for RBA rate cuts this year and the positive US lead saw Australian shares rise 1.9% to a new record high after languishing for two and half years with gains led by property, energy, health and consumer staple stocks. Reflecting the positive signs on inflation and official interest rates, bond yields mostly fell with 10-year yields in Australia falling back below 4%. The oil price fell as did metal and iron ore prices. The $A fell as the $US rose on the back of the strong payroll report.

“As goes January so goes the year”…the so-called January barometer has a mixed record when it comes to falls in January, but for gains in January it provides a reasonably consistent but not perfect guide to the year. Since 1980 85% of positive Januaries have gone on to a positive year in the US and in Australia its 76%. So with US shares up 1.6% and the Australian All Ords up 1.1% in January it’s a positive sign for the year ahead.

This doesn’t mean there won’t be corrections though and the rise in shares with US and Australian shares hitting records after a brief consolidation into mid-January has left them overbought which together with positive investor sentiment leaves them vulnerable to a short-term correction as we come into the seasonally softer months of February and March. This is particularly so with key risks around recession, US banks and commercial property, the creeping expansion of the conflict in the Middle East, the Chinese property market and uncertainty about when central banks will start to cut rates all of which could provide a trigger for a pullback. In fact, we saw a bit of the latter in the last week with the US share market initially falling after the Fed pushed back against expectations for a March rate cut

However, while shares have likely run ahead of themselves, the good news on interest rates and inflation has continued and we see this ultimately underpinning another year of gains in shares albeit it will be more constrained and volatile than was the case last year.

- Fed not rushing to cut just yet, but still heading in that direction. Sure, Fed Chair Powell pushed back against market expectations for the start of rate cuts in March by saying it was unlikely as the Fed will want to gain further “confidence that inflation is moving sustainably towards 2%.” But that was hardly surprising as the March meeting is just six weeks away. More importantly though, the Fed dropped its reference to further tightening and is now seeing the risks as better balanced and Powell continued to flag rate cuts this year and indicated it will be data dependent. Despite a strong rise in US payrolls in January (which looks partly seasonal) we continue to see the Fed cutting rates 5 times this year starting in May, but a start in March is still possible.

- Eurozone inflation fell to 2.8% in January with core inflation falling to 3.3%yoy, with ECB officials’ comments leaning a bit more dovish. The ECB is likely to start cutting in April.

- The Bank of England has dropped its hawkish bias on interest rates and like the Fed is pushing back against market expectations for early rate cuts but is starting to debate how restrictive it needs to be. Reflecting strong wages growth, its likely to lag the Fed and ECB in cutting rates but gradually appears to be heading in that direction.

- The Swedish Riksbank noted that its policy rate can probably be cut sooner than it indicated in November.

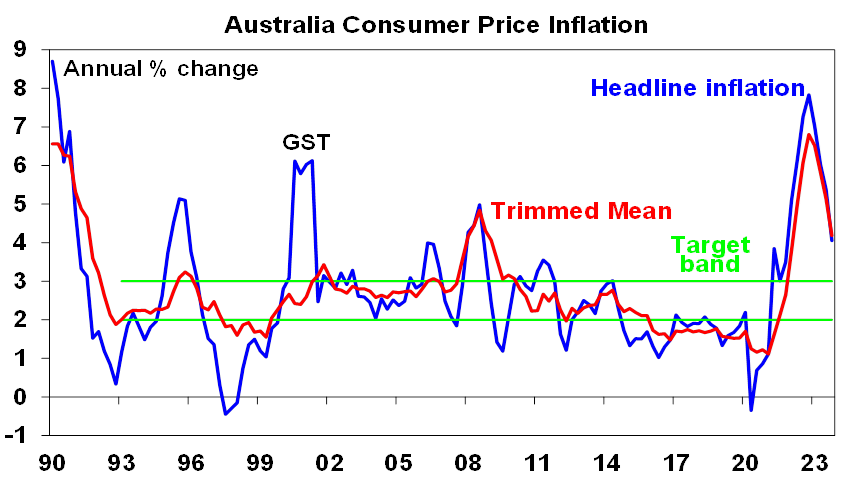

- Australian inflation is falling faster than the RBA expected. While hot spots remain (like insurance and rent) inflation fell to 4.1%yoy in the December quarter which is well below the RBA’s forecast for 4.5%, and down from 5.4% in the September quarter and a peak of 7.8% a year ago. Underlying inflation measures also fell with the trimmed mean at 4.2%yoy (below the RBA’s forecast for 4.5%) and services price inflation is now also following goods price inflation down. What’s more the proportion of items seeing greater than 3% inflation has fallen sharply to 43% which is consistent with the pre-pandemic norm and monthly CPI inflation fell to 3.4%yoy in December.

Source: ABS, AMP

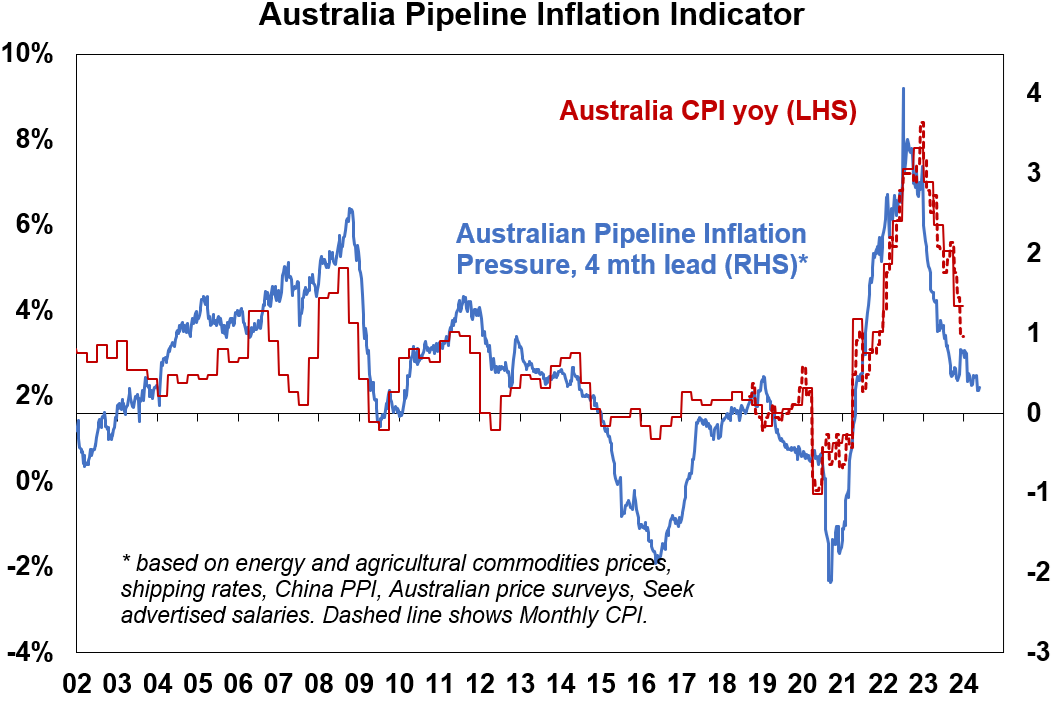

- Our Pipeline Inflation Indicator for Australian inflation continues to point to a further fall ahead and we see inflation this year falling to just below 3%, 12 months ahead of the RBA’s last forecasts.

Source: Bloomberg, AMP

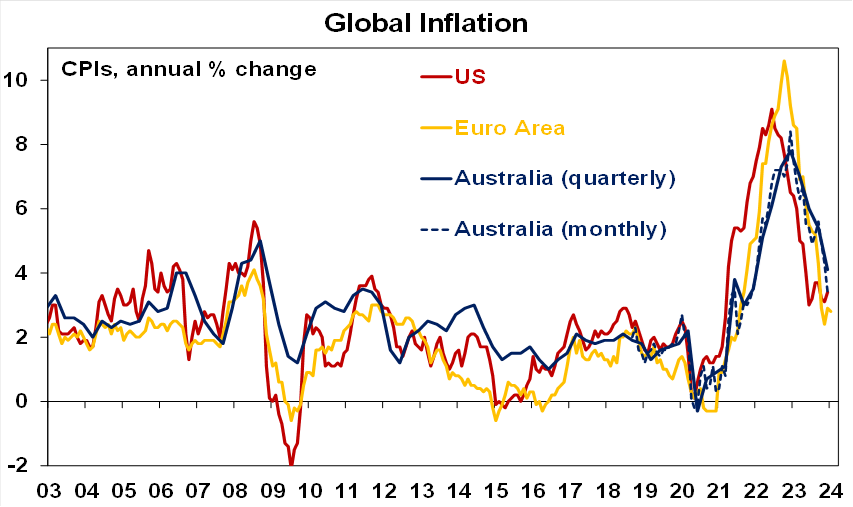

- The plunge in Australia’s inflation rate is bringing it more into line with that in the US & Europe.

Source: Bloomberg, AMP

- The faster fall in inflation than the RBA was expecting along with soft data for retail sales and jobs since their last meeting along with major global central banks slowly turning more dovish is consistent with our view that the cash rate has peaked and by mid-year the RBA will be cutting rates. Of course, like other central banks the RBA is likely to remain a bit cautious initially and don’t expect rate cuts to reverse all 13 rate hikes over the last two years but by year end we expect the RBA to have cut rates three times taking the cash rate to 3.6%. See the “What to watch over the next week” section for a preview of the RBA’s Board meeting on Tuesday.

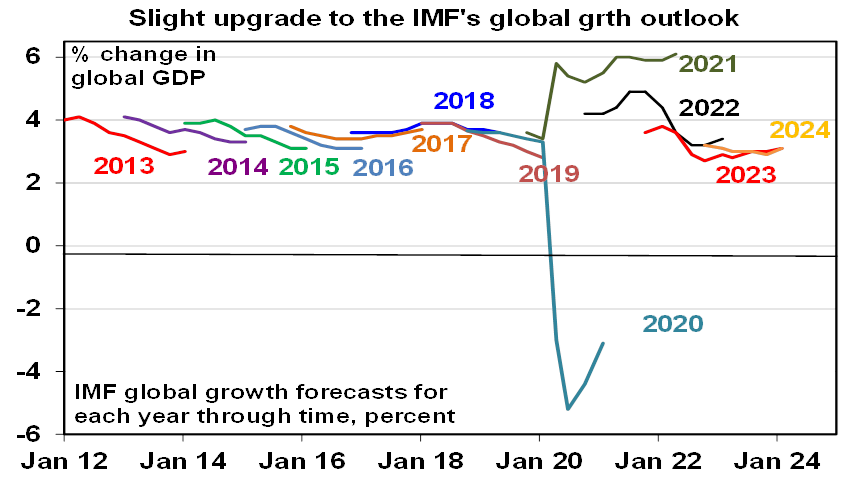

Reflecting the somewhat improved outlook the IMF revised up is global growth forecasts slightly for this year to 3.1%. The US and emerging countries were revised up offsetting downwards revisions in Europe and Japan. It continues to expect 3.2% in 2025. The IMF’s growth expectations are similar to pre-pandemic growth.

Source: IMF, AMP

Maybe the US banking and commercial property crisis is not over? Losses tied to US commercial property are continuing to cause problems in an echo of the regional bank problems seen in the US last March with New York Community Bancorp sharply boosting its loan loss reserves and Japan’s Aozora Bank announcing large losses on US commercial property. These problems could well be limited – with the New York Community bank reflecting losses on Signature Bank assets it acquired – and lower interest rates and bond yields should start to relieve some of the pressure on commercial real estate. But they provide a reminder that commercial real estate remains a problem in the US with values continuing to fall, Fed tightening cycles invariably end with some sort of crisis and the tightening in US bank lending standards flowing from the problems last year is yet to unwind. A renewed round of problems at US banks could tip the Fed into earlier rate cuts but would pose a near term threat to share market.

While news of a Hong Kong court ordering the liquidation of troubled giant Chinese property developer Evergrande at the request of its offshore debt holders caused much excitement outside of China, its not a Lehman moment that will turn China’s property downturn into a global crisis. First, its not a big surprise as Evergrande’s problems are well known. Second, its doubtful that PRC courts will allow liquidators to sell Evergrande assets in China in a fire sale given the Chinese Government’s focus on protecting home buyers and completing more homes. Finally, the Chinese Government will continue to seek to offset any impact from the property downturn and Evergrande’s woes on the economy with property and economy wide stimulus measures.

Economic activity trackers

Our Economic Activity Trackers have softened a bit in Europe and Australia but are still not showing anything decisive.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMP

Major global economic events and implications

Global data over the last week highlighted the divergence between weakness in Europe and strength in the US.

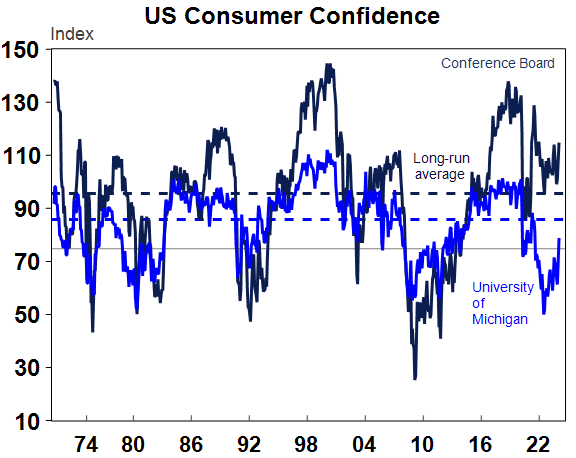

US consumer confidence rose in January, the ISM manufacturing conditions index improved (albeit it still remains soft), construction spending rose solidly & home prices continued to rise.

Source: Macrobond, AMP

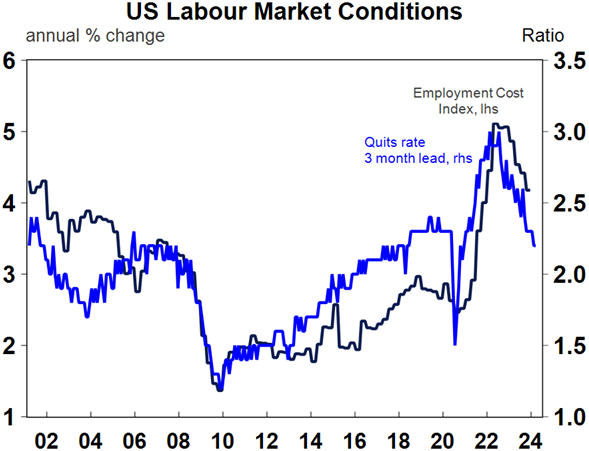

Mixed jobs reports in the US. Payrolls surged 353,000 in January with unemployment remaining low at 3.7% and hourly wages growth bouncing back to 4.5%yoy all of which will keep the Fed cautious for now. That said the blowout jobs report looks partly seasonal, the rise in hourly earnings looks due to a weather related fall in hours worked and other US jobs indicators continue to highlight that the labour market is cooling. Job openings rose in December but remain in a clear downtrend, as does the rate of people quitting for other jobs. Jobless claims also rose further. Growth in employment costs slowed in the December quarter with the fall in quits pointing to a further fall in wages growth ahead.

Source: Macrobond, AMP

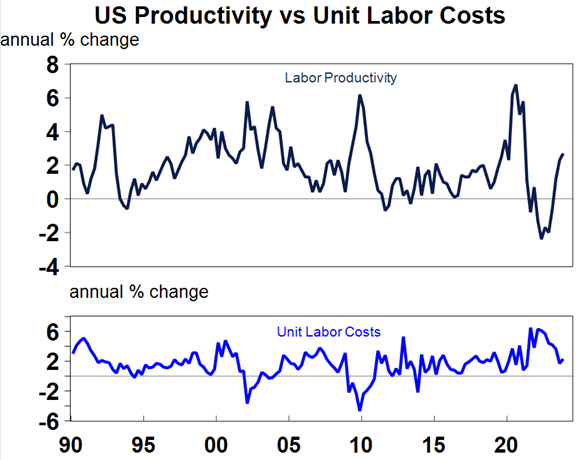

What’s more, strong productivity growth in the US means unit labour cost growth is running at levels consistent with the Fed’s 2% inflation target.

Source: Macrobond, AMP

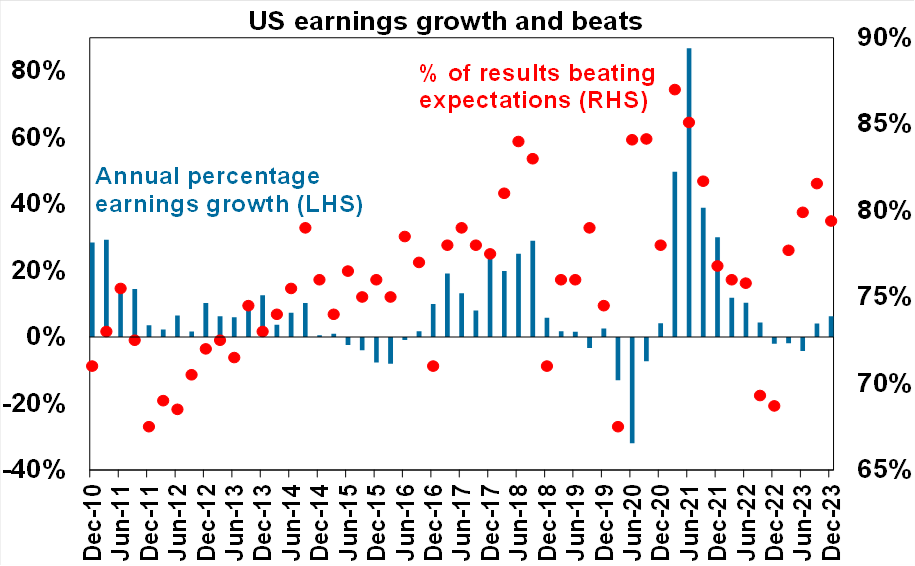

Nearly 50% of US S&P 500 companies have now reported December quarter earnings with 78% coming in better than expected, which is above the norm of 76%. So far earnings growth for the quarter is running around +6.2%yoy.

Source: Bloomberg, UBS, AMP

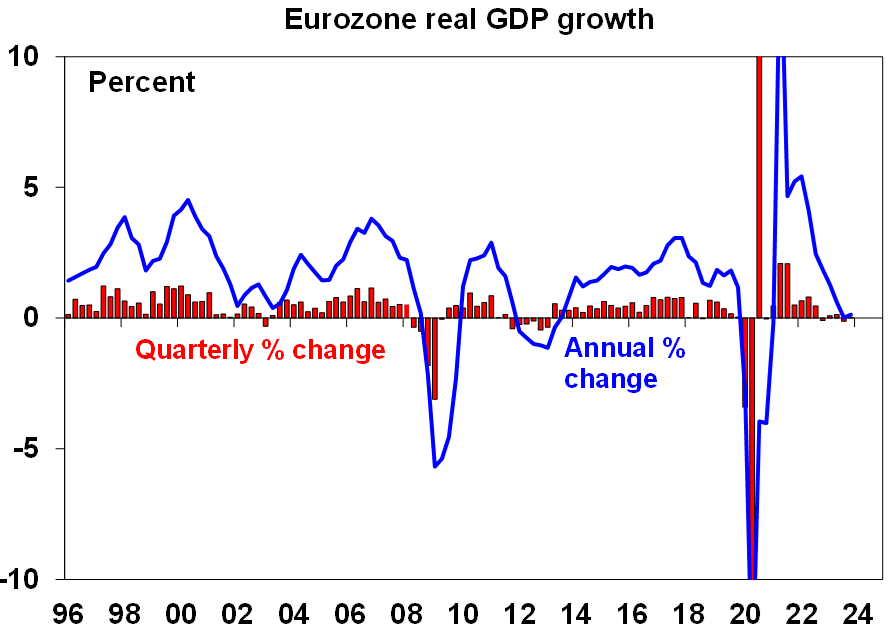

While US GDP growth surprised on the upside at an annualised 3.3% pace in the December quarter, Eurozone GDP was flat both in the quarter and the year. Economic confidence remained soft, but unemployment being a lagging indicator remained low (for Europe) at 6.4%. This should in theory be consistent with the ECB cutting rates ahead of the Fed.

Source: Bloomberg, AMP

Japanese economic data was mixed with industrial production, housing starts and consumer confidence up but retail sales down.

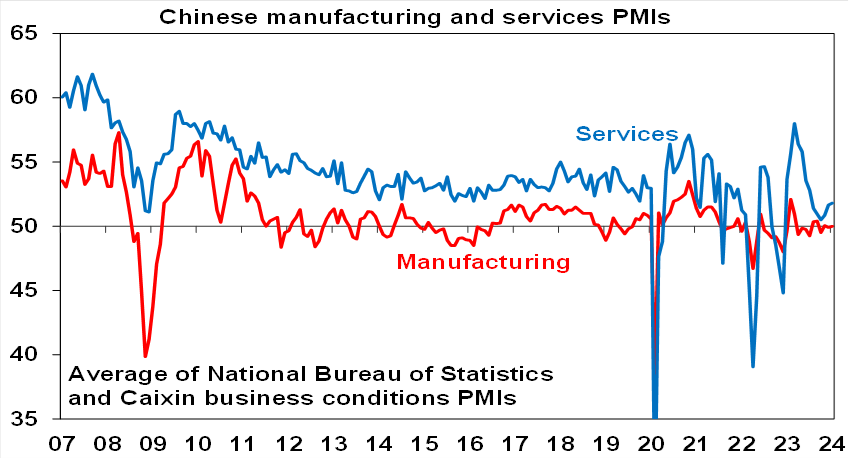

Chinese business conditions PMIs were little changed in January and remain soft – but at least aren’t warning of a slump.

Source: Bloomberg, AMP

Australian economic events and implications

Australian economic data remains consistent with weak growth, falling inflation and RBA rate cuts ahead.

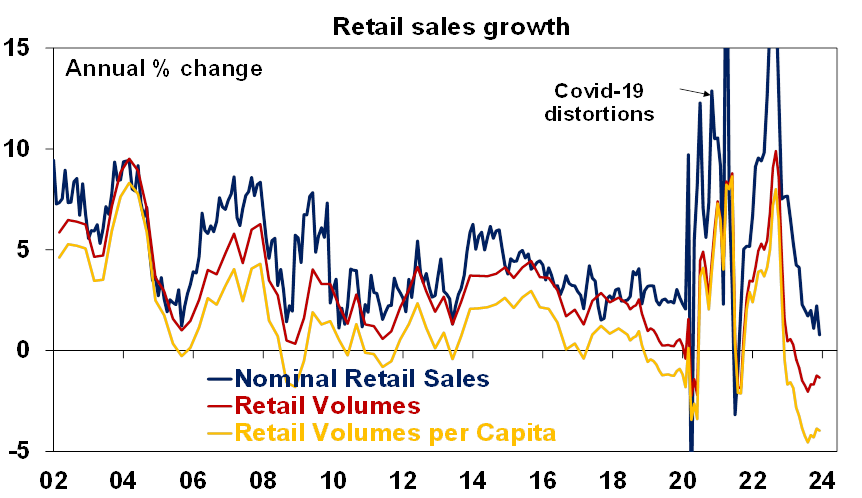

Retail sales plunged 2.7% in December more than reversing the Black Friday driven 1.6% rise in November. The fall was concentrated in discretionary items more than reversing their Black Friday boost. This leaves consumer spending still looking weak as cost-of-living pressures and high rates continue to impact. Real per person retail sales are running down 4% on a year ago.

Source: ABS, AMP

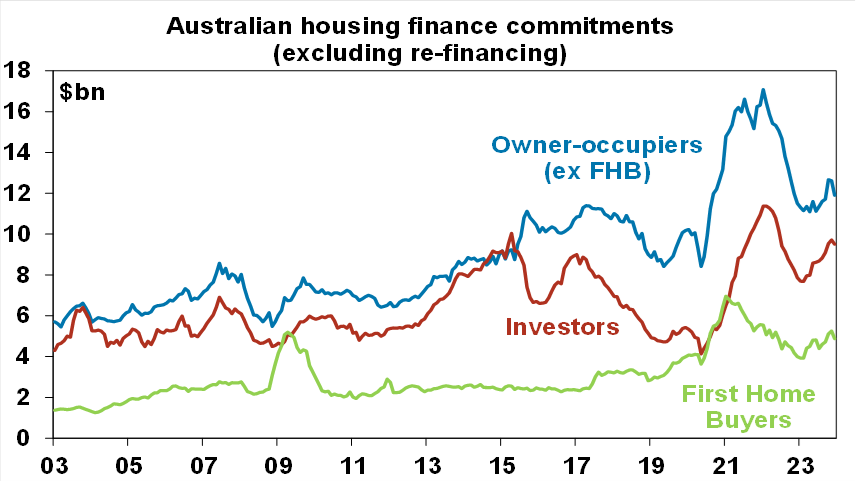

Housing indicators are soft. Building approvals plunged 9.5% in December, pointing to weak home construction ahead. Approvals totalled 162,000 in 2023 well below underlying demand for around 220,000 homes so the housing shortage will continue. Housing finance fell 4.7% in December and is 23% below its record high with housing credit growth also remaining subdued highlighting that the home price rebound came on low volumes.

Source: ABS, AMP

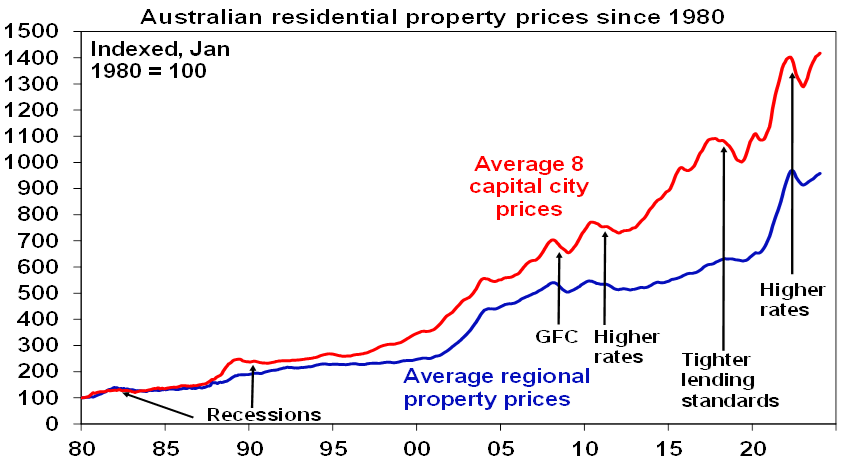

Home prices rose another 0.4% in January, which is well down from their May pace as high mortgage rates started to get the upper hand over the supply shortfall & high immigration, but they are also showing signs of resilience. Our base case remains for modest price falls this year but short of a sharp rise in unemployment there is a high risk that it turns out to be yet another very mild property downswing particularly as confidence in rate cuts continues to build.

What to watch over the next week?

In the US, the services conditions ISM index for January is expected to rise slightly and the Fed’s December quarter banking survey will provide an update on lending standards which are likely to have remained tight, with both due Monday.

Chinese CPI data (Thursday) is likely to remain in deflation.

In Australia, the RBA on Tuesday is expected to leave the cash rate on hold and further relax its already mild tightening bias, but we don’t expect it to pivot just yet towards flagging rate cuts. This meeting will see the start of the RBA’s new communication arrangements with the rate announcement and Statement on Monetary Policy at 2.30pm and a press conference at 3.30pm. It risks information overload, but it will be good to get it over with in one day! That said, Governor Bullock will also appear before the House Economics Committee on Friday. Since the last RBA Board meeting we have seen a further decline in inflation pressures globally and global central banks edging toward rate cuts, soft retail sales data, soft jobs data and inflation falling faster than the RBA expected all of which are expected to see the RBA leave rates on hold. We also expect it to lower its inflation forecasts to show inflation back at 3% or just below by June next year rather than December next year and inflation around 2.5% by the end of next year (rather than 2.9% as its currently forecasting). However, with services inflation still uncomfortably high, productivity poor and the labour market still tight the RBA is likely to remain cautious and possibly indicate that it’s too early to be talking about rate cuts. That said we think the combination of weaker growth and a faster fall in inflation than it expects will force its hand as is starting to occur in other countries and we see it cutting rates from June with three rate cuts by year end. Money market expectations are now for the start of rate cuts in June with nearly three rate cuts priced in for this year.

On the data front in Australia expect to see another solid trade surplus for December (Monday) and flat real retail sales in the December quarter (Tuesday).

A handful of Australian companies will also start to report December half earnings results including Amcor, AGL & Mirvac in the week ahead. Consensus expectations are for a 4.9% fall in earnings for 2023-24 driven by a sharp fall in energy sector profits but with strong gains in profits for utilities, health care and industrials. Key to watch will be guidance around how the consumer is holding with high interest rates and cost of living pressures.

Outlook for investment markets for 2024

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay investment returns this year. However, shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts, lower bond yields and the anticipation of stronger growth later in the year and in 2025.

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to return 9% in 2024 and rise to around 7900.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to fall in the next six months or so as high interest rates constrain demand again and unemployment rises. The supply shortfall should prevent a sharper fall & expect a wide dispersion with prices still rising in Adelaide, Brisbane & Perth. Rate cuts from mid-year should help prices bottom and start to rise again later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed moving to cut rates earlier and by more than the RBA.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.