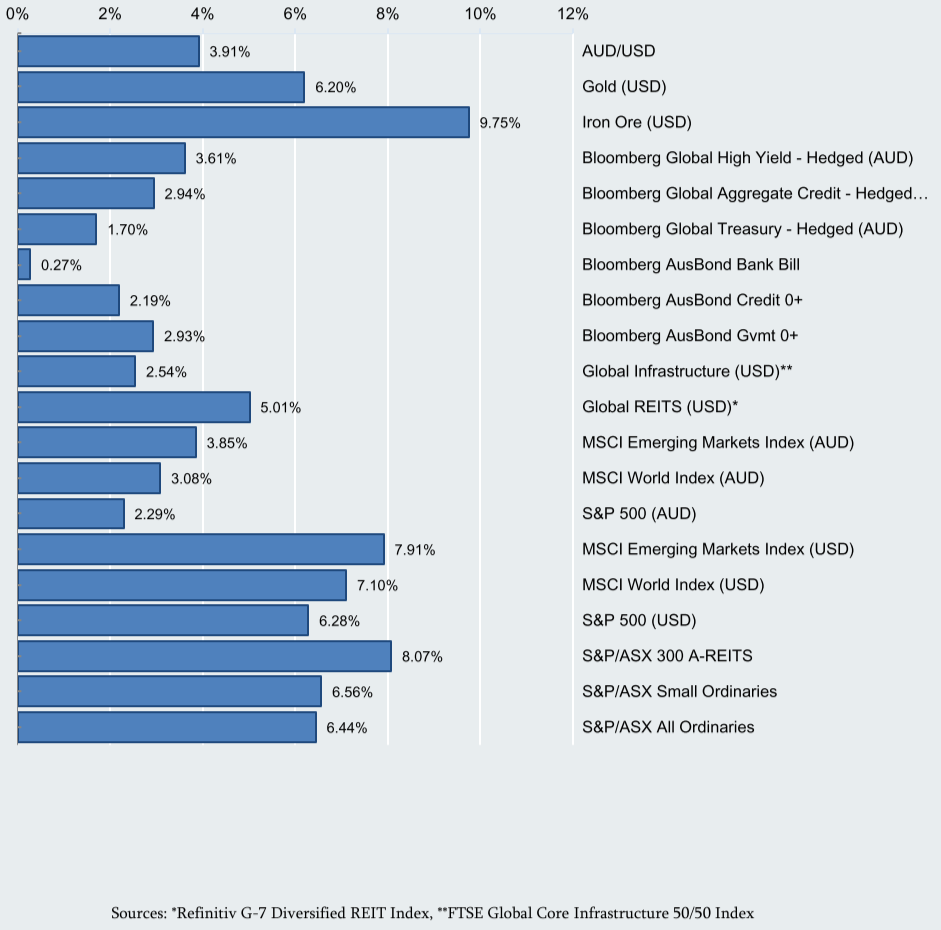

- The year kicked off in fine form, with all major market indices posting above average returns this month.

- News that inflationary pressures were starting to wane in the US caught the attention of investors, triggering strong, speculative buying with continued high hopes that central banks are nearing the end of their tightening cycles.

- Industrial metals especially iron ore, surged higher on expectations that China’s reopening will meaningfully lift demand and prop up the ailing global manufacturing cycle.

- The US Dollar fell in response to positive global economic developments, improved risk-on sentiment, as well as a narrowing of real interest rate differentials between the US and the rest of the world.

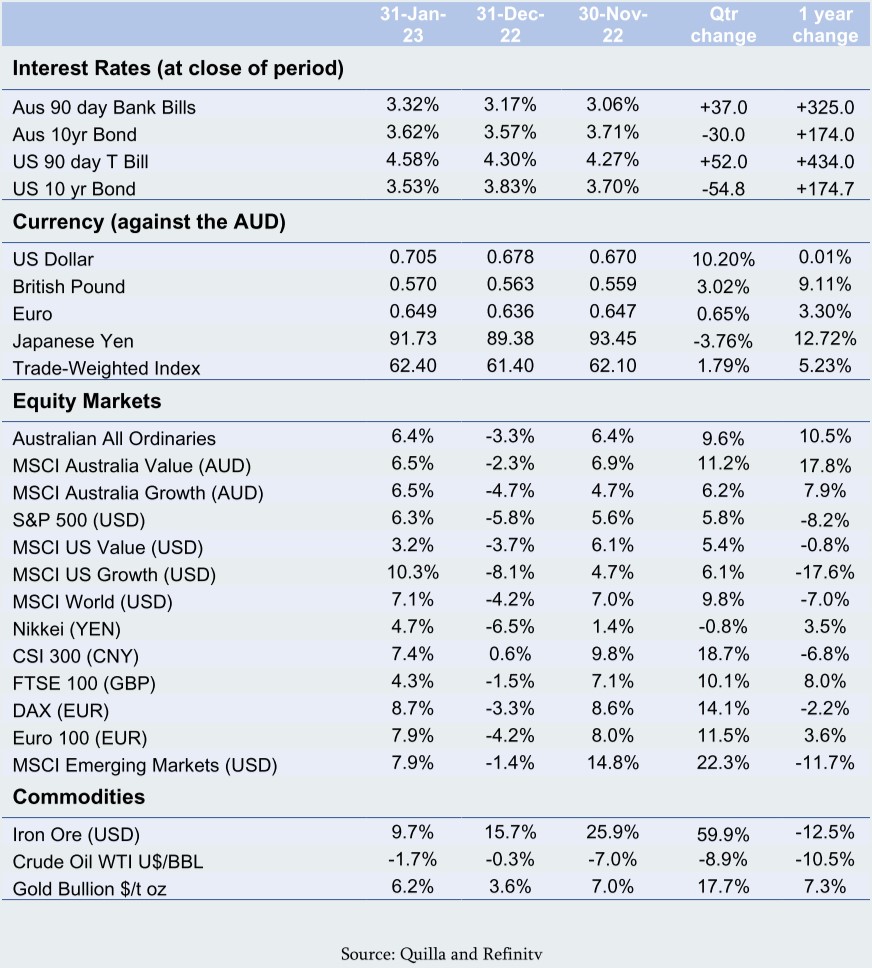

Selected Market Returns, January 2023

Key developments in January / early February

Most major financial assets enjoyed better than average returns in January. The unexpected but welcome widespread rally resulted from several positive global developments that transpired over the course of the month, including:

- News that US inflation is starting to retreat. US headline inflation eased from 7.1% to 6.5% in December. Lower energy prices drove the bulk of the deceleration in headline CPI. Core CPI also moderated from 6.0% to 5.7%. This gave the market hope that inflation has finally peaked and is on the way down.

- Falling bond yields. In part, this was the result of ongoing economic growth concerns but falling inflation is also helping. So far in 2023, the Bloomberg Global Aggregate Credit and Global High Yield indices have returned 2.9% and 3.6% respectively. These gains come after last year’s historic broad-based bond market selloff when the impact of global monetary policy tightening on yields trumped the effects of deteriorating global economic conditions. Falling bond yields have also benefitted high growth multiple stocks and sectors this month, with the NASDAQ outperforming the S&P500 and the consumer discretionary sector outperforming consumer staples recently.

- Receding fears of an energy crisis in Europe and a very mild Winter supported the Eurozone and German stock market (up +8.7% this month).

- China’s economic reopening also bolstered global cyclical assets including Chinese equities (A-shares) and emerging markets.

The positive global economic developments, improved risk-on sentiment, as well a narrowing of real interest rate differentials between the US and the rest of the world weighed on the US dollar, however. The weaker dollar, in turn, supported gold (which also benefited from lower real interest rates and central bank buying) and industrial metals which rallied enthusiastically following China’s reopening in early December.

We note that after a monthly pause, the Federal Reserve Bank (Fed) and Reserve Bank of Australia (RBA) came out swinging in early February with both central banks lifting rates again. The Fed raised rates by twenty-five basis points with Chair Jerome Powell indicating at least two more hikes are on the way.

Echoing the US, the RBA raised its cash rate by twenty-five basis points to 3.35% – marking the ninth consecutive rate hike. Importantly, the RBA’s signal that it is likely to deliver further rate increases over the coming months came as a surprise to financial market participants, with Australian government bond prices falling and the Aussie Dollar strengthening in response.

Interestingly, the RBA’s monetary policy statement highlighted that robust domestic demand as well as global factors are contributing to “higher than expected” underlying inflation and it has since revised up its forecasts as a result. Unlike the US where inflation is starting to moderate, Australia’s inflation is still to peak. The annual CPI movement of 7.8% is the highest since 1990. The past four quarters have seen strong quarterly rises off the back of higher prices for food, automotive fuel and new dwelling construction. Trimmed mean annual inflation, which excludes large price rises and falls, increased to 6.9%, the highest since the Australian Bureau of Statistics first published the data series in 2003. The services component of the CPI recorded its largest annual rise since 2008, driven by holiday travel and meals out and takeaway food.

Notably, the central bank’s expectation that CPI inflation will reach 3% by mid-2025 – the upper band of the RBA’s 2%-3% inflation target, suggests that a restrictive policy stance is warranted in Australia, much to the chagrin of nervous low income earners and mortgage holders who are all starting to feel the pinch.

Major market indicators